engineering & technology publications

ISSN 1759-3433

PROCEEDINGS OF THE TENTH INTERNATIONAL CONFERENCE ON CIVIL, STRUCTURAL AND ENVIRONMENTAL ENGINEERING COMPUTING

Bid-Price Determination Considering Cash-flow Effects

Department of Civil Engineering, National Chiao Tung University, Taiwan

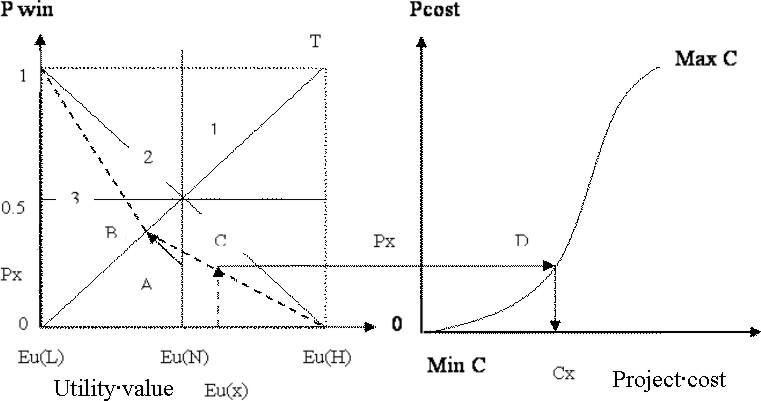

Several decision criteria guide a contractor in deciding how to price their work above or below the estimated construction costs to the contractor. The criteria that affect the bid-price appraisal may be broadly divided into three categories - environmental, company-related and project-related. The environmental criteria relate to the market conditions, bidding competition, and project value. The company-related criteria include profitability (including the risk of bidding below the cost of the project to the company), continuity of the work force, bids and work in hand. The project-related criteria involve project complexity (such as site conditions, project scale and the required construction methods), construction duration, and the contractual specifications. To capture the contractor's preferences regarding these criteria, a multi-criteria evaluation model is developed using an analytical hierarchical procedure (AHP) and the fuzzy integral method. A utility curve of reference for a particular project will be established and an expected utility value will be computed after applying this model, as shown on the left of Figure 17.1.

After conducting a quantity take-off analysis and unit-price quotation for each cost item of a construction project, the total construction cost of the project can be estimated. To further consider the effect of several economic criteria of the project, a cash-flow-based cost model is developed. These economic criteria are such as the performance bond, payment bond, advanced payment, interest rate, subcontracting amounts and price inflation. The amounts of performance bond, payment bond and advanced payment can be found in the bid documents of the project. However, the interest rate, subcontracting amounts and price inflation are treated as uncertain variables in this study. The impact of each criterion on the cost is captured in a cash flow analysis. After simulating the cost model for a specified number of iterations (i.e., randomly drawing the values of those criteria variable sin each iteration), a cumulative distribution of project cost can be generated.

Then, the procedure executes the following steps: (1) after evaluating the utility value of each criterion of the project, the expected utility value of project x, Eu(x) is computed. (2) According to the utility curve described shown on the left of Figure 17.1, find a probability, Px, with respect to Eu(x). (3) Based on the value of Px, find a recommended bid price from the cumulative distribution of the project cost. The details of the proposed procedure are demonstrated by its application to a construction project for a contractor in Taiwan. This application showss that the suggested bid price is very close to that proposed by the contractor. Namely, the proposed procedure can support contractors in bid-price assessment.

- 1

- Carr, R.I., "Competitive bidding and opportunity costs", J. of Construction Engineering and Management, ASCE, 113(1), 151-165, 1987. doi:10.1061/(ASCE)0733-9364(1987)113:1(151)

- 2

- Dozzi, S.P., AbouRizk, S.M., and Schroeder, S.L., "Utility-theory model for bid markup decisions", J. of Construction Engineering and Management, ASCE, 122(2), 119-124, 1996. doi:10.1061/(ASCE)0733-9364(1996)122:2(119)

- 3

- Fayek, A., "Competitive bidding strategy model and software system for bid preparation", J. of Construction Engineering and Management, ASCE, 124(1), 1-10, 1998. doi:10.1061/(ASCE)0733-9364(1998)124:1(1)

purchase the full-text of this paper (price £20)

go to the previous paper

go to the next paper

return to the table of contents

return to the book description

purchase this book (price £135 +P&P)